KiwiSaver basics

Your KiwiSaver account can receive contributions from three places: you, your employer and the Government.

You

If you’re employed, your contributions will likely come out of your salary or wages. You can choose how much of your income (before tax) you want to contribute to your KiwiSaver account, either:

If you're self-employed or unemployed, you can choose how much you'd like to contribute to your KiwiSaver account, and make lump sum deposits or set up a direct debit.

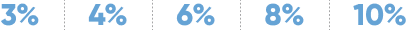

This graph shows how different KiwiSaver contribution rates can impact your account balance at retirement.*

*Based on a 30 year old with an existing balance of $15,000 in an Aggressive Growth Fund earning an annual salary of $100,000. Whos employer contributes a further 3%. Find more details under disclaimer for assumptions⁴.

Your employer

If you’re employed, your employer will also contribute a minimum of 3% of your pay into your account.

The Government

Each year in July, the Government can contribute up to $521.43 to your KiwiSaver account. To qualify for the maximum amount, you need to have contributed a minimum of $1,042.86 to your account within the last year (1 July - 30 June), be aged between 18 and 65 years, be mainly living in New Zealand, and have been a KiwiSaver member since at least 1 July of the previous year.

If you joined KiwiSaver after 1 July, or turned 18 or 65 part-way through the year, you could still be eligible for a pro-rata amount for the days you were eligible.

Find out more about the Government contribution.

Your KiwiSaver account

These contributions are all added to your KiwiSaver account and, if you are a Generate member, invested by our expert fund managers.

These investments are intended to increase in value over time, and in turn, grow your KiwiSaver savings. However, it's important to remember that investments can go up and down from month to month – this is a normal part of investing.

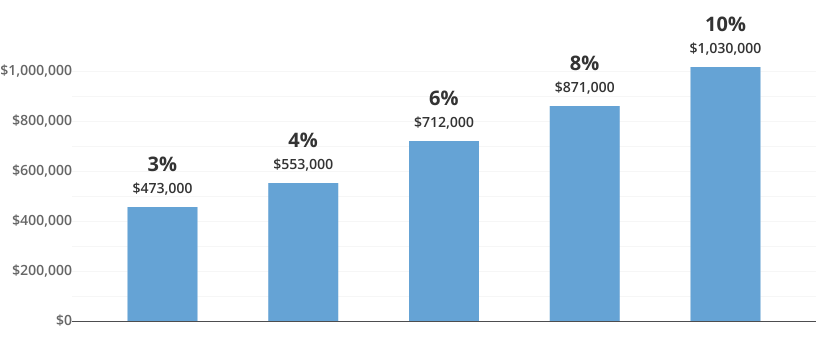

Assumptions¹: Each investor has a starting balance of $20,000. Each investor remains employed at all times until their retirement age of 65. No withdrawals are made. Their salaries grow by 3.5% per annum and they earn a 5.5% per annum return after tax and fees. Each investor continues to receive the full Government contribution. Each investor is invested in an aggressive fund. Inflation is assumed to average 2% per annum. The investors and their employers each contribute 3% of the investor’s before tax pay into the investor’s KiwiSaver account. The employer‘s contributions are net of employer’s superannuation contribution tax at current rates. Balances are expressed in real terms as a current dollar amount.

When can you withdraw your money?

KiwiSaver is a long-term savings plan, designed to help set you up for later in life. As KiwiSaver is designed for retirement, you are not able to access these funds whenever you like. That applies to all KiwiSaver providers, not just Generate.

There are typically only two times in life when you will be able to tap into your KiwiSaver savings:

- When you are buying your first home. Find out about first-home withdrawals.

- When you reach NZ Superannuation age (currently at 65 years)

You may be able to make an early withdrawal in limited circumstances

- Significant financial hardship

- Serious illness

- Permanent emigration

- A life-shortening congenital condition

- Deceased estate

- Trans-Tasman transfer to an eligible Australian Superannuation provider

Contact us for more information.

What are the benefits of KiwiSaver?

The genius of the KiwiSaver scheme is that it gives you benefits that you can’t get from any other investment. These include:

A minimum of 3% contribution from your employer

If you’re contributing to your KiwiSaver account from salary or wages, your employer is required to put in a minimum of 3% of your Before Tax Pay on top of your normal wages.

An annual contribution from the Government

For every $1 you put into your KiwiSaver account, the Government will add 50 cents, up to a maximum Government contribution of $521.43 per year³. This KiwiSaver bonus is added to your KiwiSaver savings, every year.

Find out more about the Government contribution.

Your KiwiSaver is held in a trust

Generate customers have peace of mind knowing that Public Trust (a crown entity) are the supervisor of Generate and your KiwiSaver savings are held by them as custodian.

First home withdrawal eligibility²

Never owned a home before? When you've been a KiwiSaver member for three years, you may be eligible to withdraw funds from your KiwiSaver account to put towards your first home.

Some terms and conditions apply, see details: Buying your first home with KiwiSaver.

Up to $10,000 first home grant³

Plus, you may also qualify for up to $10,000 from the Government as a First Home Grant. This could be just the boost you need. Find out more.

Disclaimers